As a crypto trader, one of the most essential rules to thrive and grow in the crypto exchange space is to comply with myriads of regulatory compliances. Treating compliance as simply a check-the-box exercise could result in a heavy amount of penalties and loss of licensing rights due to critical regulatory violations. Recent Coinbase compliance issues demonstrate why comprehensive customer digital onboarding with fool-proof compliance oversight and protection is essential.

Below, we uncover what precautions your institution can take to properly follow KYC laws and avoid similar compliance issues.

Coinbase Compliance and Regulatory Risk

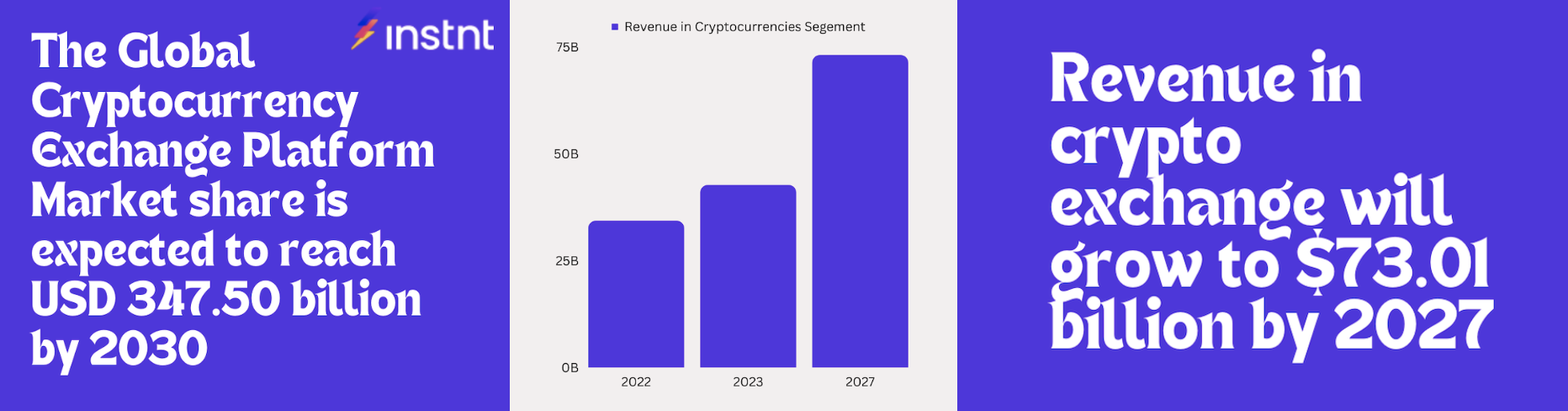

The global crypto trading market is growing at a CAGR of 30.08%. It is estimated that the cryptocurrency exchange platform will touch $347.50 billion by 2030, as per a report published by Spherical Insights & Consulting. Revenue in crypto exchange will grow to $73.01 billion by 2027.

The supremacy of Coinbase in the digital currency exchange space is clear. The crypto trader operates in more than 100 countries with more than 56 million clients globally. Coinbase views KYC/AML compliance as a serious commitment to customer protection, keeping itself abreast of key regulatory requirements.

Even with a greater push for compliance programs, Coinbase fell prey to huge non-compliance risks. The New York Department of Financial Services found its centralized exchange platform to have shortcomings for compliance programs. With vulnerabilities ranging from money laundering and narcotics trafficking, Coinbase's compliance issues cost them $100 million in the settlement with DFS.

- $50 million will be invested in the compliance program

- Another $50 million will be paid as a penalty to the New York regulator

Due to the inadequate transaction monitoring system and suspicious activity reporting, Coinbase faced a backlog of 100,000 unreviewed transactions and customer due diligence for over 14,000 customers.

The possible reason that most crypt traders are struggling with continuous monitoring and improvement for KYC/AML compliance programs is the nascency of the crypto ecosystem. Most third-party tools and technologies lack adequate innovation and sophistication to help accommodate the changing compliance needs around the crypto ecosystem.

If your compliance program is shoddy, chances are your legacy platform fails to take advantage of AI-powered, integrated, and fully-managed digital customer onboarding technology. As a result, you expose yourself to fraud vulnerabilities and also run the risk of paying 2.65x the actual cost of compliance fees.

Non-Compliance Business Impacts

What if your business also suffers compliance risks similar to Coinbase compliance issues? There are far-reaching financial impacts and reputational harm your business can suffer, including:

|

Difficulty of monitoring account activity |

Susceptibility to fraud |

Lack of data analytics |

|

If your transaction monitoring system is weak, it is challenging to monitor the account activity. As a result, you can inadvertently allow the inactive account to withdraw money more than the threshold limits. |

Scammers can transfer and convert thousands of millions of stolen funds into digital tokens and later remove them from your exchange. |

You will have insufficient and less insightful data to prepare accurate reporting for KYC compliance. As a result, you put customer trust at stake, forcing you to incur more future losses. |

Non-Compliance Solutions

Investing in a decentralized-powered digital customer acceptance platform like Instnt mitigates the above risks and drives customer loyalty and retention. Institutions that partner with Instnt can expect to spend $0 in fraud exposure compared to $819K without Instnt. A decentralized infrastructure provides a more secure and compliant environment for crypto exchange than a centralized storage system. Your customer identities remain encrypted because of the enterprise-grade blockchain deployments.

This technology advancement can give your customers self-sovereign identity management capabilities without the risk of exposing them to cybersecurity risks or synthetic bots for possible threats of account takeovers. It means no scammers can disguise and cause identity theft and compliance risks to your business.

Instnt is part of Hyperledger Foundation, the global ecosystem for enterprise blockchain technologies.

- By leveraging W3C verifiable credential standards and decentralized identity management, Instnt helps your business trade lawfully and efficiently, keep pace with the changing environment of KYC regulation laws around the crypto ecosystem and provide friction-free digital customer onboarding.

- Instnt employs behavioral and device intelligence using advanced AI-powered machine learning and algorithms that continuously monitor suspicious activity. With workflows to monitor end-to-end sessions, Instnt enables you to track, verify and correlate user interactivity with mouse movement, keystrokes, touch screen and device movement. Even with a subtle sign of anomalies, Instnt can trigger real-time fraud alerting. Before any major threat occurs, you can take action and prevent transfers, which is highly beneficial for businesses to build a robust transaction monitoring mechanism and avoid compliance risks.

- In addition to making KYC programs compliant and robust, Instnt uses advanced data analytics to help you harness data on suspicious activity and other malicious attempts by cybercriminals. As you have the flexibility to prepare accurate reporting and you can establish trustworthiness for your business while building a platform for future growth.

How Does a Fully-managed Solution Ensure Compliance?

Due to strict compliance policies, financial institutions or crypto traders often gather fragmented or disjointed compliance tools. Organizations often work in silos with a set of tools to accept customers and another set of tools to manage identity verification to data management. Unfortunately, these tools only add up to customer friction, as they need to supply information back and forth during digital customer onboarding and periodic KYC checks.

In contrast, Instnt’s fully-managed Soc 2-compliant digital customer onboarding platform brings all data points together, eliminating the need to manage fragmented IT infrastructure while providing single-sign-up flexibility to customers. User information is seamlessly stored in a wallet in a decentralized fashion, which allows access to a variety of financial products just by scanning a QR code. Your customers will appreciate the frictionless KYC process, and you can ensure long-term customer retention.

Instnt can also help implement a digital customer onboarding process with advanced KYC checks preferred by all leading crypto exchanges or financial institutions. Coinbase and other organizations follow a variety of KYC processes, including:

- Photo Identity Verification

- Document Verification for Driver’s license, Passport, or ID card

- Personal Information Verification such as residential address or email address

- OTP-based Multifactor Authentication for device ownership

- Selfie Verification

- Biometric Authentication

Instnt ensures you implement these rigorous KYC verification steps without adding to customer frustration, keeping processes fast and simple for more a streamlined customer experience. Just by leveraging automation capabilities and workflows, you can easily set up these functionalities in the digital customer onboarding dashboard. Before you create your customer sign-up flow, ensure you check these KYC verification options to build a more robust customer due diligence process.

Prioritize KYC with Instnt

Coinbase compliance issues highlight the need for KYC solutions in the crypto world. We at Instnt are pushing to help financial institutions and digital asset agencies operate confidently and responsibly by staying compliant with the most rigorous KYC compliance programs regulators employ. What’s more, Instnt shifts fraud loss liability off your balance sheet by ensuring loss liability shift, fraud loss indemnification and fraud loss protection.

Need assistance in making your KYC program compliant? Book a demo today to see how we can help you build mission-critical workflows with automation, saving you time and fostering business resilience.

Sources

Integrify - Five Ways to Reduce the Cost of Compliance

Finbold - How Long Does Coinbase Verification Take? | KYC Guide [2023]

Fortune Crypto - Coinbase just reached a $100M settlement with New York regulators. Here’s what that means for crypto